Politics or perceptions?

The global economic crisis that began in 2008 has once again put public finances at the heart of academic and public debate. In many countries, public debt has soared to unsustainable levels and forced governments to implement austerity measures, with severe economic and social consequences. The worst affected countries are those where public finances had developed structural weaknesses well before the crisis.

Such fiscal problems are generally explained as an indiscipline inherent in the democratic system. For example, it is often argued that voters are short-sighted, that they exploit future generations or that they are uninformed about the country’s fiscal position.

I propose an explanation of budget deficits that does not build upon this notion of political failure. Instead, I examine how the fiscal performances of advanced democracies have been affected by biased economic projections. The underlying idea is that economic policy is based on policy makers’ perceptions of the economy – rather than on actual economic conditions – and that we cannot fully understand the development of public finances if we only take the latter into account. In brief, the argument rests on the following two claims.

- Governments adjust fiscal policy after how they perceive the economic situation. When they believe the economic situation to be ‘worse than usual’, they respond with more expansive policies. There are two reasons for this behaviour. First, they want to increase aggregate demand to get the economy back on track. Second, they believe that the budget balance will improve as the economy gets back to normal.

- Economic perceptions are biased, so that we tend to believe that we are in a temporary downturn even when economic conditions in retrospect turn out to have been favourable.

If both these claims are true, fiscal policy has been more expansive than it would have been if economic perceptions were unbiased.

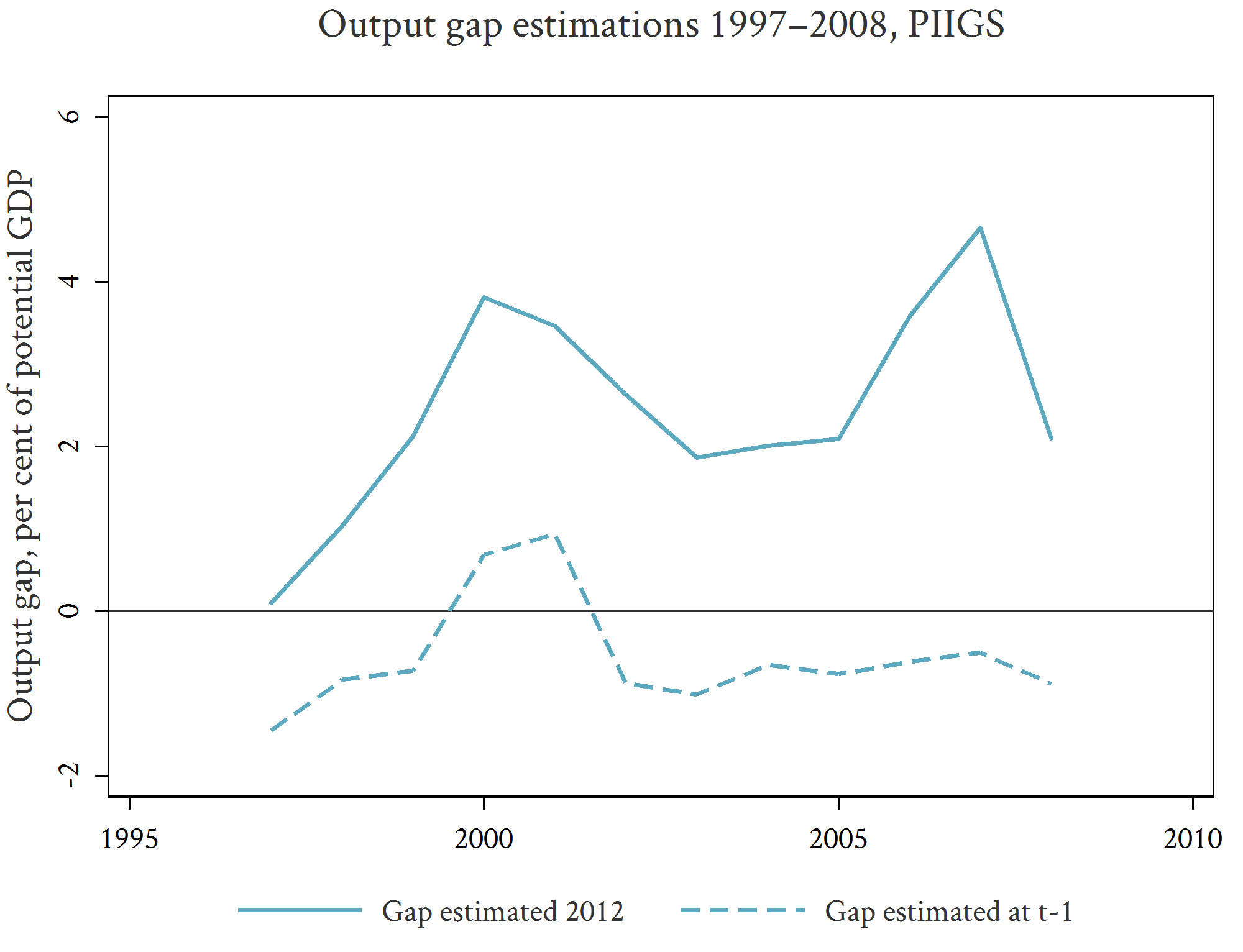

As an illustration of how policy makers' perceptions can differ from ex-post estimations, the graph below shows the business cycles of Portugal, Ireland, Italy, Greece and Spain – measured as an average of the output gap estimations that the OECD has made for these countries.1 The most recent assessments are represented by a solid line, and the real-time projections, i.e., the projections made at the time that budgets were passed, are represented by the dotted line. As shown by the solid line, today these economies are judged as having performed well above their potential throughout the period. In retrospect, it appears to have been a golden decade and a great opportunity to consolidate public finances. It is therefore easy to condemn the lax fiscal policies of these countries and invoke the standard politico-institutional explanations of their high debt levels. However, as the real-time projections show, these countries have repeatedly been told that they are in the midst of economic downturns, with output below long-run potential.

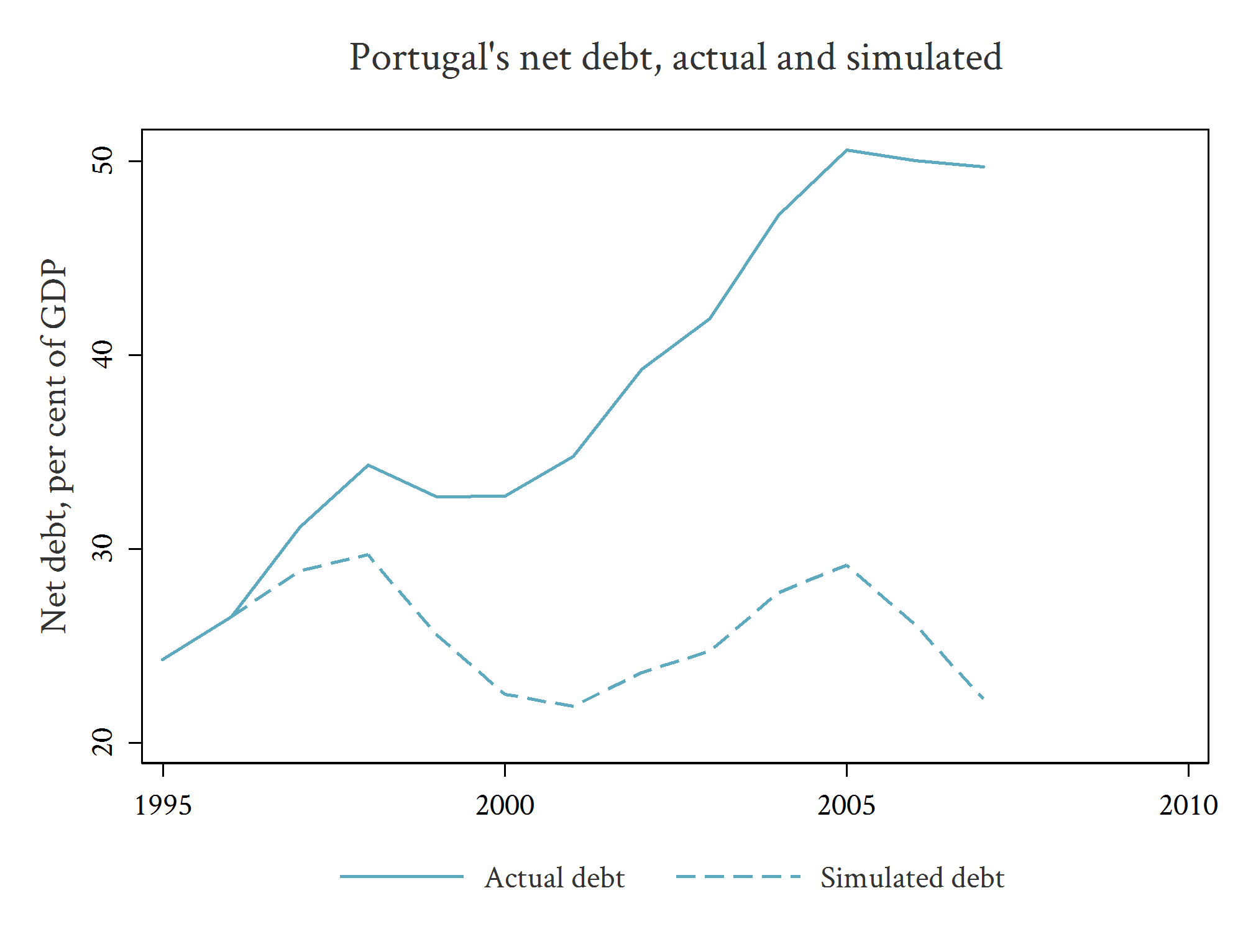

To support the claim that fiscal policy is affected by economic perceptions, I have run regressions of the budget balance as a function of both economic perceptions (the real-time estimations of the output gap) and economic realities (the revised estimations of the output gap). They show that the real-time estimations have had a large impact on fiscal policy. On average, biased projections have weakened annual budget balances by approximately one per cent of GDP. For some countries the effects are even larger. The graph below shows a simulation of how the public debt of Portugal would have developed if projections had been in line with actual outcomes.